Short week, short blog. BUT, last week was noteworthy since most equity indices were up over 2.25% and some were up even more (see chart inside for more details of last week’s markets). Still feeling blue about the equity markets? Well, this should cheer you up… did you know that the S&P 500 is up a little over 5.5% off of its bottom on February 3rd? Did you know that the S&P 500 is almost flat for the year after last week? So what gives? Well it’s more than just some Yellen in the Hizzy. (That’s a mash-up of some pop culture and Gen Y speak for those Baby Boomers out there.) Don’t be scared – mash the hyperlink and read on.

- P: 703.504.9600

- |

- E: info@monumentwm.com

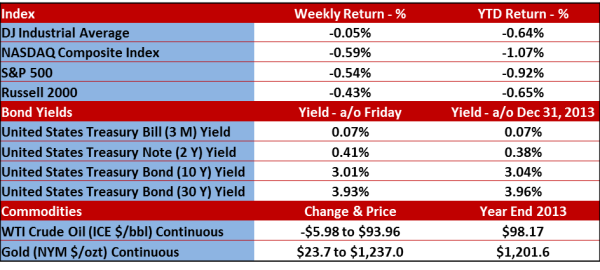

Last week was the worst week since the summer of 2012 for the S&P 500 index. It was down -2.6%. The DJIA was off even more, shedding -3.5%. So what gives? With almost a 30% run in the S&P 500 for the 2013 calendar year, is it a big deal that it has moved 3% off its all-time high? Are the bears awakening?

Last week was the worst week since the summer of 2012 for the S&P 500 index. It was down -2.6%. The DJIA was off even more, shedding -3.5%. So what gives? With almost a 30% run in the S&P 500 for the 2013 calendar year, is it a big deal that it has moved 3% off its all-time high? Are the bears awakening? Emma Thompson knows how to party! This is a picture of her at the Golden Globes last weekend and it cracked me up. Finally there was something other than the teleprompter slog that had me more interested in a 3-month-old copy of Handyman Magazine than the awards show. It’s also possible that she just got her 2013 statements and decided to party despite the Dow being down -0.80% so far this year. Rewind a year ago and the Dow was up +4.0% on news that we averted the Fiscal Cliff. Things are so BORING now with no crisis and all this capital gains selling from a rocking 2013…

Emma Thompson knows how to party! This is a picture of her at the Golden Globes last weekend and it cracked me up. Finally there was something other than the teleprompter slog that had me more interested in a 3-month-old copy of Handyman Magazine than the awards show. It’s also possible that she just got her 2013 statements and decided to party despite the Dow being down -0.80% so far this year. Rewind a year ago and the Dow was up +4.0% on news that we averted the Fiscal Cliff. Things are so BORING now with no crisis and all this capital gains selling from a rocking 2013…

A shortened week and record closes on both the Dow Jones Industrial Average (Dow) and the Standard & Poor’s 500 (S&P 500) indices…I’ll take it! Last week there was the feared taper news and the market actually went up making every talking head on CNBC who was doom and glooming the subject look pretty stupid. With year-to-date returns of almost 24% for the Dow and 28% for the S&P 500, maybe I’ll get all the presents I’ve asked for this year. Except a Tesla – I scratched that gift off the list and asked for a cord of firewood instead.

A shortened week and record closes on both the Dow Jones Industrial Average (Dow) and the Standard & Poor’s 500 (S&P 500) indices…I’ll take it! Last week there was the feared taper news and the market actually went up making every talking head on CNBC who was doom and glooming the subject look pretty stupid. With year-to-date returns of almost 24% for the Dow and 28% for the S&P 500, maybe I’ll get all the presents I’ve asked for this year. Except a Tesla – I scratched that gift off the list and asked for a cord of firewood instead.  One is very hot and can easily erupt into a fireball. The other has cooled. With the both the Standard & Poor’s 500 (S&P 500) and the Dow Jones Industrial Average sell off over 1.65% each, you can guess which one is which. Investors took cover as once again, the talk of Fed tapering swirled around the rumor and speculation mill. In fact, it was the largest weekly sell off in the past three months but there was some good economic news as well.

One is very hot and can easily erupt into a fireball. The other has cooled. With the both the Standard & Poor’s 500 (S&P 500) and the Dow Jones Industrial Average sell off over 1.65% each, you can guess which one is which. Investors took cover as once again, the talk of Fed tapering swirled around the rumor and speculation mill. In fact, it was the largest weekly sell off in the past three months but there was some good economic news as well.  I am writing a short blog for this week since I have to figure out how to deep-fry a turkey and ensure my homeowner’s fire insurance is up to date. I can get lost for hours on YouTube with videos of exploding turkey fryers. Anyway, come on in. While it’s freezing in D.C., our blog site is toasty warm with a chart from a Wall Street Journal article that I think every investor should see. Are we in a bubble? See for yourself. In addition, MWM received a major accolade from a major media source in the Washington D.C. area!

I am writing a short blog for this week since I have to figure out how to deep-fry a turkey and ensure my homeowner’s fire insurance is up to date. I can get lost for hours on YouTube with videos of exploding turkey fryers. Anyway, come on in. While it’s freezing in D.C., our blog site is toasty warm with a chart from a Wall Street Journal article that I think every investor should see. Are we in a bubble? See for yourself. In addition, MWM received a major accolade from a major media source in the Washington D.C. area! Another week and another new high for the Dow Jones Industrial Average (Dow) – AND as I write this, the Dow is trading above 16,000 for the first time in history. In fact, the Standard and Poor’s 500 index (S&P 500) and the Dow both logged their sixth-consecutive weekly advance. Though we are still measuring the impact from the government shutdown on the economy (remember that?), the commotion we suffered in October is fading into the sunset and the spotlight is returning to the Fed, the recent earnings activities and economic activity. But read more – I have cool pictures of trains in this week’s blog!

Another week and another new high for the Dow Jones Industrial Average (Dow) – AND as I write this, the Dow is trading above 16,000 for the first time in history. In fact, the Standard and Poor’s 500 index (S&P 500) and the Dow both logged their sixth-consecutive weekly advance. Though we are still measuring the impact from the government shutdown on the economy (remember that?), the commotion we suffered in October is fading into the sunset and the spotlight is returning to the Fed, the recent earnings activities and economic activity. But read more – I have cool pictures of trains in this week’s blog!