There is no shortage of advice out there on what to do next in the market – present writer included – but I was recently reminded of the famous quote, “Don’t underestimate the value of doing nothing, of just going along.” Who said it? Winnie the Pooh. Of course he also said “I am a bear of very little brain and long words bother me.”

There is no shortage of advice out there on what to do next in the market – present writer included – but I was recently reminded of the famous quote, “Don’t underestimate the value of doing nothing, of just going along.” Who said it? Winnie the Pooh. Of course he also said “I am a bear of very little brain and long words bother me.”

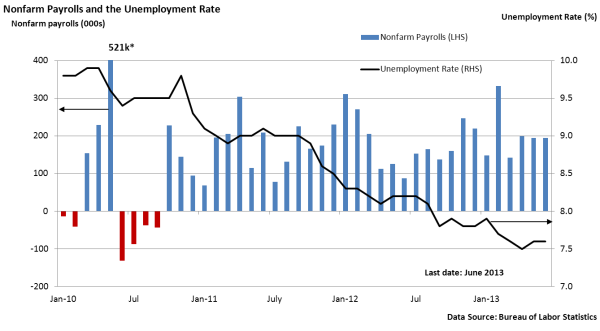

Since we are discussing bears, they are all running for cover as the markets have hit new highs once again. On Thursday, the Standard & Poor’s 500 (S&P 500) hit a new all-time high and is now up almost 150% from the lowest posted on March 9, 2009. Viewed another way, the S&P 500 has gone 1,592 days without a correction of 20%, which is the classic definition of a bear market. The record was set between 1987 and 2000 where the index went 4,494 days without a 20% decline. Email me if you’d like the exact technical spec of what defines a bull and bear market.

I took a two week break from blogging as I attended a great industry conference on the west coast and then had knee surgery to reconstruct a torn ACL in my knee. I was making such good progress on my golf game and then that happened. Summer is now over, my knee has more colors than a Jackson Pollock painting and the next thing you know we’ll be setting the clocks back and driving in the dark at 4:30pm.

I took a two week break from blogging as I attended a great industry conference on the west coast and then had knee surgery to reconstruct a torn ACL in my knee. I was making such good progress on my golf game and then that happened. Summer is now over, my knee has more colors than a Jackson Pollock painting and the next thing you know we’ll be setting the clocks back and driving in the dark at 4:30pm.

There is no shortage of advice out there on what to do next in the market – present writer included – but I was recently reminded of the famous quote, “Don’t underestimate the value of doing nothing, of just going along.” Who said it? Winnie the Pooh. Of course he also said “I am a bear of very little brain and long words bother me.”

There is no shortage of advice out there on what to do next in the market – present writer included – but I was recently reminded of the famous quote, “Don’t underestimate the value of doing nothing, of just going along.” Who said it? Winnie the Pooh. Of course he also said “I am a bear of very little brain and long words bother me.”

As a reminder, the markets and Monument Wealth Management will be closed on Thursday, July 4th. We will also have a 1 p.m. EDT closure Wednesday since it is a half day for the exchanges.

As a reminder, the markets and Monument Wealth Management will be closed on Thursday, July 4th. We will also have a 1 p.m. EDT closure Wednesday since it is a half day for the exchanges.  This song was made famous to Gen X by Murph and the Magictones in the movie The Blues Brothers and is a cover of an

This song was made famous to Gen X by Murph and the Magictones in the movie The Blues Brothers and is a cover of an